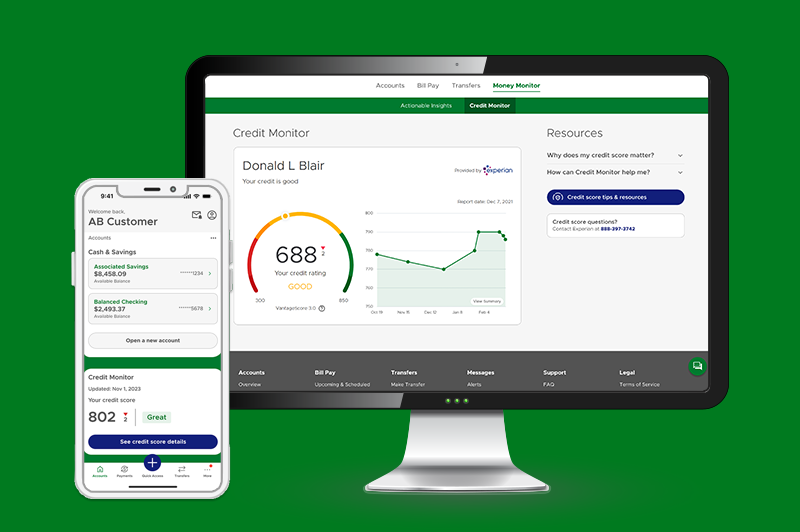

Credit Monitor

Keep an eye on your credit score easily from anywhere. Get alerts, tips and more—automatically.

Your credit follows you everywhere. Credit Monitor¹ lets you do the same with your credit picture. And it’s free with most of our checking accounts!

Credit Monitor

From mortgages to everyday spending and even job searches, your credit has far-reaching impact. That’s why we include Credit Monitor with Associated Balanced Checking® and Associated Choice Checking®.

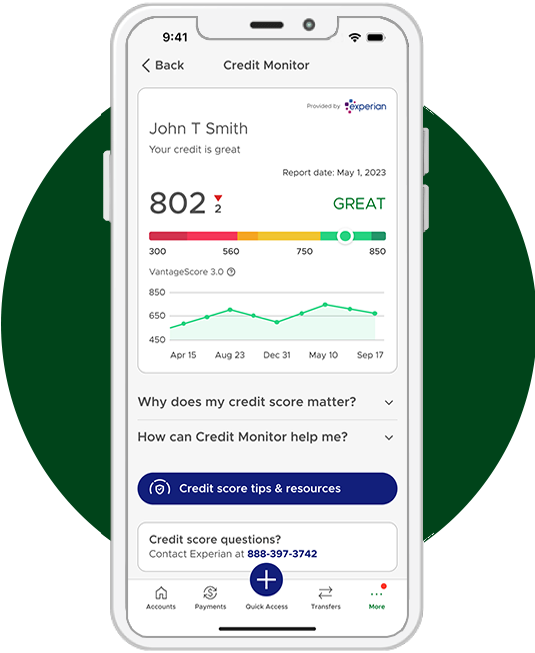

Get a quick glance at your credit health:

- Monthly updates of your credit score.

-

Automatic email alerts of changes to your credit.

- How your credit score is trending, graphing its movement month over month.

- Access to credit education around what your score means, how it’s calculated and used and other info.

Already have Access Checking? Consider upgrading to Balanced or Choice Checking. You’ll get the money-smart features of Credit Monitor for free and when you set up direct deposit,² no monthly fee for Balanced Checking. Make your move today—schedule an appointment to speak with a banker.

Credit Monitor+¹

Protect your hard-earned credit with Credit Monitor+, included free with Platinum Choice and Private Banking accounts. You’ll get all the features of Credit Monitor, plus:

- Credit Insights: Access in-app credit alerts, score simulators and debt analysis.

- ID Protect & Restore:³ Safeguard your identity 24/7/365 from online fraud with identity monitoring and restoration services.

- Comprehensive Monitoring: Choose to protect your phone number, home address and Social Security number. Get alerts for any signs of fraud.

- Restoration Services: Receive personalized assistance for restoring your identity and guidance when working with the IRS, DMV, courts and other agencies.

- Identity Theft Insurance: Coverage up to $1,000,000 for expenses related to identity theft, including document replacement, travel and legal costs.

Not a Platinum Choice or Private Banking account holder? Contact your local banker to upgrade and enjoy the benefits of Credit Monitor+.

Want to open an account in person?

Frequently asked questions

How do I get Credit Monitor?

Your must have one of the checking accounts listed above to qualify for Credit Monitor. To activate it, sign in to Associated Bank Digital (either online or mobile). On your Accounts Overview page, you’ll see a card for Credit Monitor. Click on it and accept the terms and conditions. You can also click on the “More” button at the bottom of the page, select Money Monitor and then Credit Monitor. It’ll show up automatically after that.

What credit score does Credit Monitor provide?

Credit Monitor and Credit Monitor+ are powered by Experian and give you your VantageScore 3.0 score. If you have any questions about this score or report, contact Experian directly at 888-397-3742.

Will checking my credit score with Credit Monitor lower it?

No. You can monitor your score as often as you like without impacting your credit. The VantageScore 3.0 credit score that you see in Credit Monitor is for educational purposes only and Associated Bank will not use it to make credit decisions.

What kind of alerts will Credit Monitor give me?

Credit Monitor and Credit Monitor+ customers will receive email alerts when one of the following posts to their credit report:

- New inquiry

- New account

- New delinquency

If you have Credit Monitor+, you’ll receive digital banking alerts—not emails—for the notifications below. To read them, sign in to Associated Bank Digital, go to Credit Monitor and select “Credit Alerts.”

- New Inquiry: A potential employer, creditor or other third party has pulled your credit file.

- New Trade: A new account was added to the borrower's credit file.

- Delinquent: You missed a payment on an account and the account is now as much as 90 days late. At 120 days late, the Major Derogatory alert is sent.

- Major Derogatory: Your account is in a state that damages you credit score.

- Card Over Limit: You’ve exceeded the credit limit on a card account.

- Lost Or Stolen Card: You’ve reported a card as lost or stolen.

- New Address: Your primary address has been changed.

- Settlement: You’ve settled an account by paying the creditor an agreed-upon amount.

- Tradeline Bankruptcy: An account was added to a bankruptcy.

- Public Record Bankruptcy: You’ve filed for bankruptcy.

- Skip Cannot Locate: Unspecified but potentially negative information was added to one of the your accounts.

What kind of ID Protect alerts will Credit Monitor+ give me?

When you add these types of personal information to ID Protect, you’ll receive alerts in Associated Bank Digital under Credit Monitor > ID Protect > Identity Alerts:

- Mailing addresses

- Email addresses

- Phone numbers

- Medical IDs

- Social Security numbers

- Driver’s license numbers

- Passport numbers

- Financial information such as credit & debit cards and bank account numbers

You’ll receive these alerts in to Associated Bank Digital under the ID Protect menus:

- Change of Address: Helps to catch unauthorized changes to your current or past addresses by monitoring the National Change of Address (NCOA) database and U.S. Postal Service records. If a change occurs, you’ll be notified the moment it happens.

- Social Security Monitoring (SSN): Monitors your SSN in real-time, detecting usage across a variety of situations including loan applications, employment and healthcare records, tax filings, online documents signings and payment platforms. You’ll receive immediate alerts, so you can proactively control your identities.

- Dark Web Monitoring: Scans millions of servers, online chat rooms, message boards and websites across all sides of the web to detect fraudulent use of your personal information. You’ll receive an alert instantly if your identity is compromised.

Credit Monitor+ customers that experience identity theft can contact our Restoration Service call center at 1-833-568-6249 for assistance.

Related Articles

Information provided through the Credit Monitor feature in Digital Banking is provided by Experian. For full information, see the Credit Monitor section of the Digital Banking Service Terms and Conditions. (1488)

Monthly maintenance fee is waived for Balanced Checking when direct deposit or mobile deposit totals $500 or more per statement cycle. For other ways to waive the monthly maintenance fee please refer to the Associated Balanced Checking Product Disclosure or product information brochure. (1486)

Customers eligible for Credit Monitor+ have access to Identity Protect & Restore services. For details about identity monitoring, restoration, and insurance see the Credit Monitor section of the Digital Banking Service Terms and Conditions. (1489)

To use Credit Monitor, eligible customers must log in to digital banking, activate the feature, and accept the terms and conditions. Information provided through Credit Monitor is obtained by Experian. For more information, visit here. (1485)

Associated Bank does not charge a fee to download our digital applications; however, transactional fees may apply. Carrier message and data rates may apply, check your carrier’s plan for details. Visit AssociatedBank.com/disclosures for Terms and Conditions for your service. (1406)