Digital Banking Alerts

Get custom notifications about your accounts—when and where you want.

Keep on top of your account activity. With Associated Bank Digital,¹ it’s easy to set up and customize your choice of push notifications, emails or texts to alert you of deposits, transfers and balances.

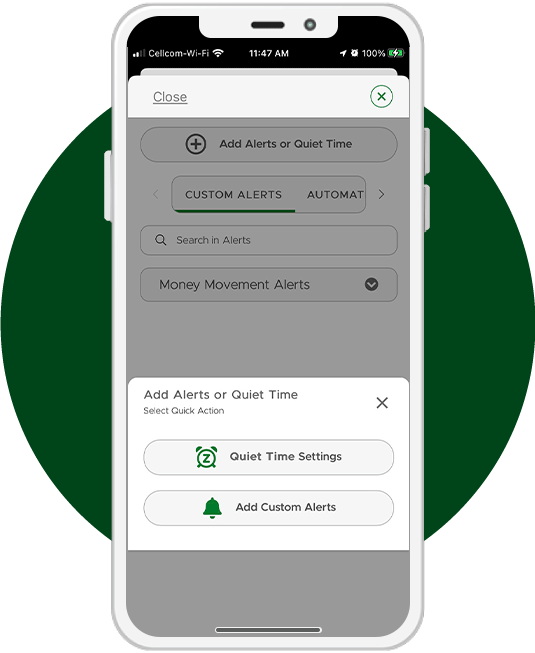

Choose alerts to let you know when your balance is low (or high), when a transaction takes place, when to make a payment² and more—important tools to help you manage and safeguard your money. You can even set up quiet times when we won’t send you custom alerts.

And if something doesn’t seem quite right, Associated Bank Digital always sends you fraud alerts³ for your protection—automatically.

To set up your custom alerts, sign in to Associated Bank Digital.

- On your desktop, select the Alert Preferences dropdown.

- If you’re using the mobile app, select the More tab and click the Alerts icon.

- From there, set your alerts to fit your banking style and preferences.

Follow these helpful demos on how to set up alerts on your computer or on your mobile phone.

Why should you set up customized alerts?

- Get instant notifications about account activity on your smartphone when you're out and about.

- Guard against fees and overdrafts. Push notifications can let you know when your balance drops below the amount you’ve chosen.

- Know the minute you've received a deposit.

What kinds of alerts are available?

- Custom alerts—Track money movements like new deposits, available balances (above or below) and transaction amounts.

- Automatic alerts—Know when a device has been added, usernames or passwords have been changed and when you’ve received a secure message from us. We’ll also let you know if we find suspicious activity on your account.³

- Quiet time—Sometimes you don’t want to be disturbed. Select times to “pause” your custom alerts. Note that you’ll always receive security alerts.

To receive account alerts, you’ll need to enroll in Associated Bank Digital.

Alerts: Frequently Asked Questions

Can I get text alerts rather than push notifications?

Yes. To get text (SMS) alerts, you'll need to click on your profile picture in the upper right of the screen. Click on “Profile” and then “Contact info.” Choose “Edit Contact” and click the “Add Text/SMS.” Click “Save.” You'll receive an MFA (authentication) prompt. Follow the instructions to complete the setup.

Associated Bank does not charge a fee to download our digital applications; however, transactional fees may apply. Carrier message and data rates may apply, check your carrier’s plan for details. Visit AssociatedBank.com/disclosures for Terms and Conditions for your service. (1406)

Our standard bill payment service, found within digital banking, is free, up to your available balance. Accelerated delivery services within the bill payment service have additional service charges. Please refer to the Terms and Conditions of the Bill Payment Service, the Consumer Deposit Account Fee Schedule, or the applicable Checking Product Disclosure for details. (1064)

Fraud Text Alerts are available to Associated Bank debit cardholders who have mobile service through a participating carrier and have their mobile phone number on file with Associated Bank. Participating carriers include AT&T, Sprint, T-Mobile and Verizon. Additional carriers may be added over time. Associated Bank does not charge a fee to send debit card Fraud Text Alerts.