Monthly Economic and Market Summary

Economic Reports Drive October Markets

| Monthly Return | Year-to-Date Return | 1-Year Return | |

|---|---|---|---|

| S&P 500 Large Cap | -0.92% | 20.96% | 37.99% |

| S&P Midcap | -0.71% | 12.72% | 32.96% |

| S&P Small Cap 600 | -2.64% | 6.41% | 29.90% |

| MSCI EAFE (Dev. Foreign) | -5.43% | 7.40% | 23.65% |

| MSCI Emerging Markets | -4.32% | 12.11% | 25.87% |

| Barclay’s 1-3 Year Gov’t Bonds | -0.61% | 3.50% | 5.78% |

| Barclay’s Gov’t Credit Bonds | -1.60% | 3.00% | 8.20% |

Market Return Data (as of 10/31): Bloomberg

- October Jobs Report—The U.S. labor market added fewer jobs than expected in October, affected by the recent hurricanes and a Boeing workers strike. According to the Bureau of Labor Statistics, 12,000 payrolls were added, below economists’ expectations of 100,000. Additionally, the unemployment rate remained steady at 4.1% and wage growth rose to 4.1% year-over-year.

- Effects of the Hurricanes—Hurricanes Helene and Milton, may be among the most destructive on record, with financial damages estimated at around $50 billion. Besides severe property destruction, the storms have disrupted supply chains and may slow U.S. Gross Domestic Product (GDP) growth.

- Bond Market—The 10-year Treasury yield rose to 4.29% in late October, the highest level since mid-July, up from around 3.6% in September. Treasury prices have declined amid a strong economy, raising doubts about future Federal Reserve (Fed) rate cuts. The presidential election added further uncertainty with speculation that the proposed fiscal policies could push yields higher.

- Credit Card Debt—Higher prices and rising interest rates have likely impacted credit card debt. According to Bankrate, nearly 2 in 5 credit cardholders have either maxed out or come close to maxing out a card since the Federal Reserve began raising rates in March 2022. Average balances per consumer now stand at $6,329, a 4.8% increase year over year, per TransUnion’s latest credit industry insights.

- Gold Prices Rising—Gold prices reached near-record highs, rising 34.2% year to date through October 31st, driven by central-bank demand and safe-haven appeal amid Midde Eastern and Ukrainian conflicts. Gold’s strength has been resilient, despite higher bond yields and a strong U.S. dollar. Since 1976, gold has never gained over 30% in a year when the S&P also gained over 20%, with 2009 as the only year where both rose over 20%.

- U.S. GDP—In the third quarter, the U.S. economy grew slightly slower than expected. The Bureau of Economic Analysis reported a 2.8% annualized growth rate, just under economists’ forecasts of 2.9%. The reading came in lower than the 3% growth in the second quarter.

SPEAKING OF TAXES

In 2017, the Tax Cuts and Jobs Act (TCJA) was passed to reduce taxes for many households and businesses. Given some TCJA provisions end in 2025, it is worth exploring what impact a full expiration or extension may have on the economy and fiscal deficits.

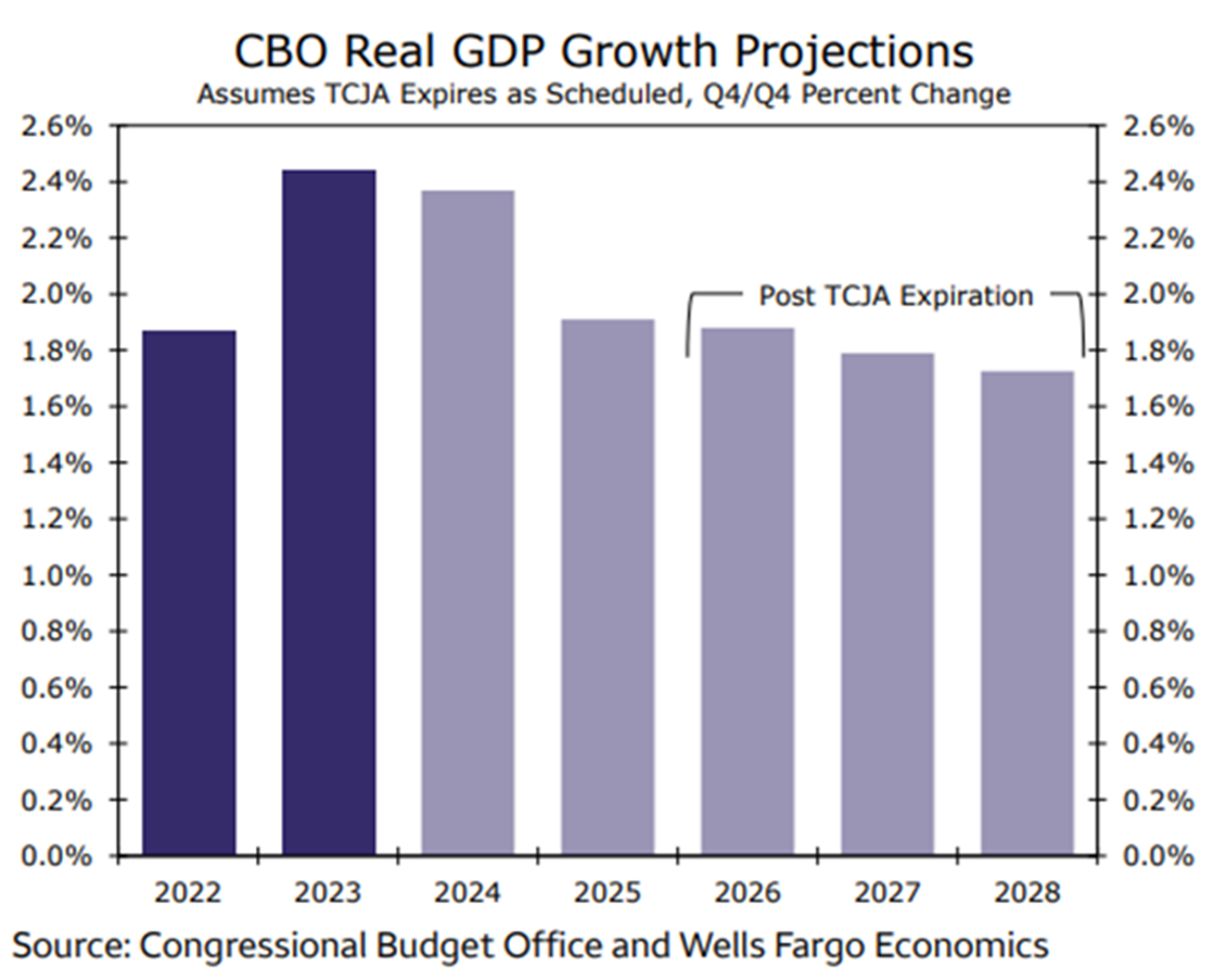

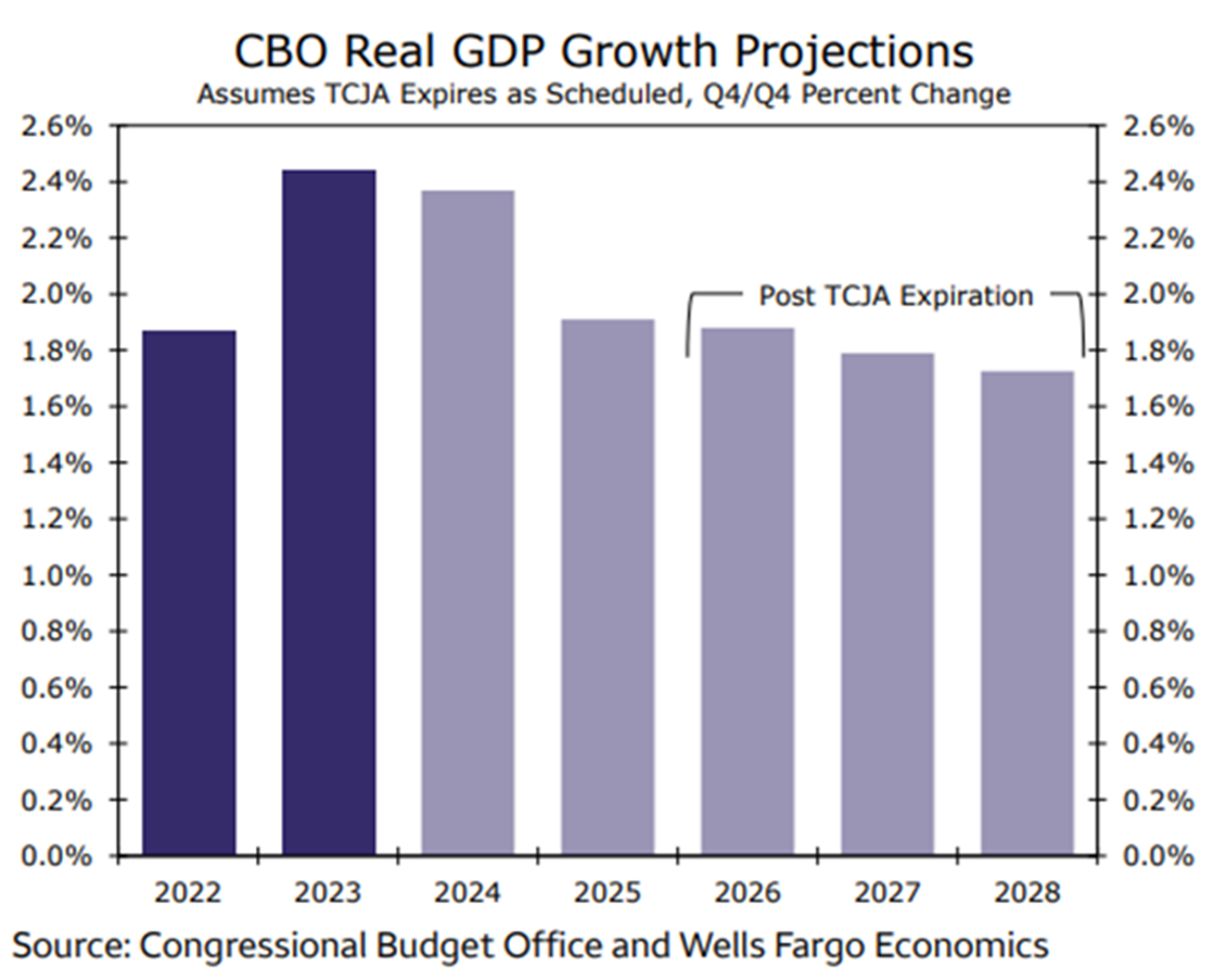

According to the Congressional Budget Office (CBO), the full expiration would cause a few tenths of a percentage point decrease in gross domestic product (GDP). As shown in the below chart, that impact would be small enough to avoid recession in 2026-2028. It may also help to mitigate fiscal deficit growth, as well.

If the extension is passed without offsets to the fiscal accommodation, it could lead to mounting deficits while providing no excess benefit to economic growth. The CBO estimates that the deficits would be 1.2–1.6 percentage points of GDP larger per year over the next decade raising the federal deficit spending to 7-8% of GDP.

Whether there is an expiration or extension of the TCJA, it is likely there will be plenty of debates to address any impact on economic growth and fiscal deficits. Election night will be the first step that determines the direction of the TCJA debate.

Investment, Securities and Insurance Products:

NOT

FDIC INSUREDNOT BANK

GUARANTEEDMAY

LOSE VALUENOT INSURED BY ANY

FEDERAL AGENCYNOT A

DEPOSITAssociated Bank and Associated Bank Private Wealth are marketing names AB-C uses for products and services offered by its affiliates. Securities and investment advisory services are offered by Associated Investment Services, Inc. (AIS), member FINRA/SIPC; insurance products are offered by licensed agents of AIS; deposit and loan products and services are offered through Associated Bank, N.A. (ABNA); investment management, fiduciary, administrative and planning services are offered through Associated Trust Company, N.A. (ATC); and Kellogg Asset Management, LLC® (KAM) provides investment management services to AB-C affiliates. AIS, ABNA, ATC, and KAM are all direct or indirect, wholly-owned subsidiaries of AB-C. AB-C and its affiliates do not provide tax, legal or accounting advice. Please consult with your advisors regarding your individual situation. (1024)

Readers should not consider this update of the economic and investment environment as analysis upon which to make investment decisions or recommendations of strategies or particular securities. Always consider whether particular investments are appropriate for your situation and consult with your financial advisor regarding the appropriateness of any recommendation to your investment objective. Past performance is no guarantee of future returns. Read the prospectus before investing; it contains information about a mutual fund’s risks, investment objectives, fees and expenses. You may obtain a prospectus for any mutual fund from your financial advisor or directly from the mutual fund company you choose.